Herefordshire Council does not hold any offshore investments, a freedom of information request has revealed.

The local authority currently holds £40.61m worth of investments in a mixture of with money market funds, UK banks and other councils.

Officers say they only invest in institutions recommended by the authority’s treasury adviser through combined credit ratings, credit watches, and credit outlooks.

An information access officer said: “The council continues to restrict investments to only the largest and strongest of the banks, building society, other local authorities and instant access Money Market Funds.

“None of the council’s investments are for a period exceeding 364 days.

“Typically the minimum credit ratings criteria the council use will be short term rating (Fitch or equivalents) of F1 and a long term rating of A- and with countries with a minimum sovereign credit rating of AA- (Fitch or equivalents).”

The investments as at May 8, 2019 are £30.71m in money market funds (UK and Ireland), £5m in other UK local authorities and £5m in British banks.

Drug dealer with distinctive tattoo caught red-handed

Drug dealer with distinctive tattoo caught red-handed

New substation to boost reliability across Monmouthshire

New substation to boost reliability across Monmouthshire

Bridge repairs could begin soon says Monmouth MP

Bridge repairs could begin soon says Monmouth MP

Raft Race raises more than £11,000 for hospice

Raft Race raises more than £11,000 for hospice

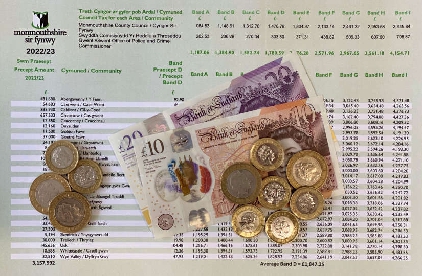

Budget plan proposes council tax rise and hiking parking and other charges

Budget plan proposes council tax rise and hiking parking and other charges