Herefordshire households are likely to see a full 5 per cent rise in council tax from April.

Herefordshire Council’s cabinet this afternoon (January 26) agreed a proposed budget for the 2023/24 financial year, which it consulted on with the public last month.

It proposes raising total council tax rates by 4.99 per cent, the new maximum permitted by the Government, and split between a 2 per cent raise ring-fenced for adult social care, and a 2.99 per cent increase for all other council services.

This would increase the tax on a typlical band D home to £1,786.61, an increase of £7.08 a month.

The council says the proposed increase is needed to support the continued delivery of vital services.

“Our priority is to get the best possible value for every pound we spend on the people of Herefordshire,” it said.

The council will continue to operate a means-tested council tax reduction scheme, and young adults who have left care, and all the council’s foster carer families, will continue to pay no council tax at all.

The budget will now have to be passed by a full meeting of county councilllors on February 10.

But the final setting of council tax, including “precepts” for local parishes, the Police and Crime Commissioner and Hereford & Worcester Fire Authority, will not be confirmed until the following full council meeting, on March 3.

The Courtyard Announces First Wave of Headline Acts for The Amp

The Courtyard Announces First Wave of Headline Acts for The Amp

Recommendation made for Shropshire fire service council tax hike

Recommendation made for Shropshire fire service council tax hike

Police investigating damage in Ludlow

Police investigating damage in Ludlow

Council tax being reduced in Bishop’s Castle

Council tax being reduced in Bishop’s Castle

New takeaway plan for former bank

New takeaway plan for former bank

Ludlow councillor calls for action over deteriorating building

Ludlow councillor calls for action over deteriorating building

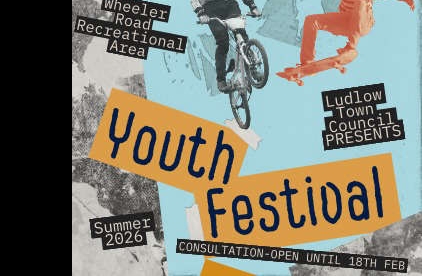

Council launches consultation for Summer 2026 Youth Festival

Council launches consultation for Summer 2026 Youth Festival

Resurfacing works planned for road near Church Stretton

Resurfacing works planned for road near Church Stretton