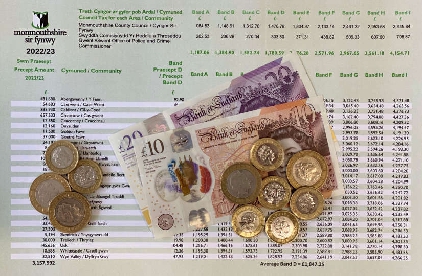

Residents in Monmouthshire could see a 4.95 per cent council tax increase as part of the county council’s 2021/22 budget proposals.

Alongside the council tax increase, the council’s cabinet is proposing more than £3.6 million in cuts to help with £10 million in budget pressures. The council’s overall budget sits at just over £170 million.

The council tax increase of 4.95 per cent would see bills for a Band D property increase by £68.35 a year, or £1.31 a week. The current annual council tax rate for a Band D property is £1,381.

While the council has put forward a balanced draft budget proposal, it includes a one-off contribution from the council’s general reserve balance of £749,000. The general reserve is made up of funds set aside to meet the councils future needs.

The council’s main concerns include a budget pressure of £3 million in adult children’s social care, £1.5 million in children with additional learning needs, £1.4 million in recycling and waste and £900,000 in both transport and homelessness support.

What are the main budget pressures?

- Children with additional learning needs – £1.47 million pressure from demand to support pupils from an earlier age and continuing support into post-16 education.

- Looked after children – £1.46 million extra needed for placement, legal and staffing costs.

- Delivery of adult social care – £790,000 from an increase in fees for external care providers and an extra contract to meet shortfall in the Usk area.

- Recycling and waste – £1.4 million from increased costs of treatment and disposal and reduced grant funding.

- Passenger transport unit – £917,000 from an increase in in-house service and loss of private hire income.

- Homelessness – £874,000 from Welsh Government homelessness review, which could be mitigated by a grant.

- Unbudgeted elements – £918,000 from pay awards and staff cuts.

- Lack of income – £777,000 from income losses from the pandemic that are not being met by the Welsh Government’s hardship fund or are not achievable for the upcoming year.

What services are being cut/changes are being made?

The closure of Mounton House special school in 2020 will free up £1.2 million for the council budget in 2021/22.

The council also says it will benefit from Welsh Government guidance that allows the local authority to make flexible use of capital money and costs, which could help the council claw back an additional £1 million.

Despite pressures from a reduction in grant funding, the changes to garden waste collection, the introduction of polypropylene bags and a reduction in tonnage to landfill will give the council an additional £685,000.

An increase in fees and charges, alongside new charge is likely to generate an additional £415,000 in income for the council.

The increase in grant funding for the social care workforce will provide an additional £247,000 and offset existing pressures in the adult social care budget.

What impact will coronavirus have on the budget?

The Welsh Government has already announced that coronavirus costs and income loss will be dealt with separately to the funding given for council budgets.

For this reason, Monmouthshire council has excluded these from the council’s budget setting as they will be dealt with in due course by the Welsh Government.

What happens now?

The cabinet will decide whether to proceed to a formal consultation period, which will last four weeks ending on February 17.

Work on replacing ageing Victorian water pipe in Monmouth to continue

Work on replacing ageing Victorian water pipe in Monmouth to continue

Designer appointed for redevelopment of Hereford Museum and Art Gallery

Designer appointed for redevelopment of Hereford Museum and Art Gallery

Charities calling for clarity on when new base for people with disabilities will be available

Charities calling for clarity on when new base for people with disabilities will be available

Hereford car showroom plan for new SUV brands

Hereford car showroom plan for new SUV brands

‘Improved’ plan to replace turkey sheds with houses near Leominster

‘Improved’ plan to replace turkey sheds with houses near Leominster

Emergency services respond to explosion at BAE Systems Monmouthshire site

Emergency services respond to explosion at BAE Systems Monmouthshire site

Legal challenge launched to prevent demolition of Three Counties Hotel

Legal challenge launched to prevent demolition of Three Counties Hotel

Number of empty homes in Monmouthshire reduces since council tax premium

Number of empty homes in Monmouthshire reduces since council tax premium